Santander Bank

Official company name: Santander UK plc.

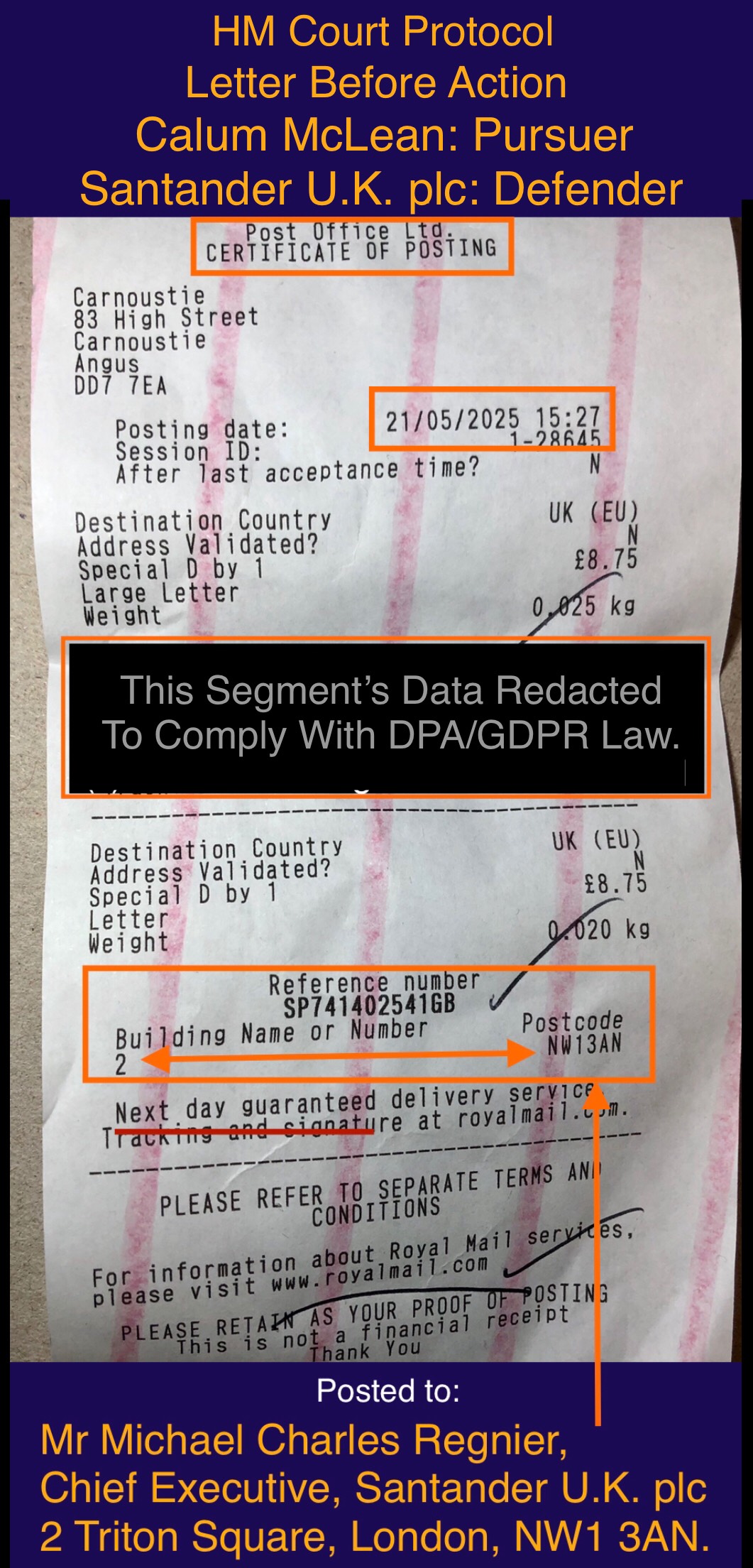

In case, by some miracle, a member of management at the horrendous Santander Bank reads this, please note that as of 22nd May 2025, your company has very little time to sort out the mess your organisation has made. Herewith the evidence that our Advocate (Scottish barrister) has indicated may be disclosed at this time…

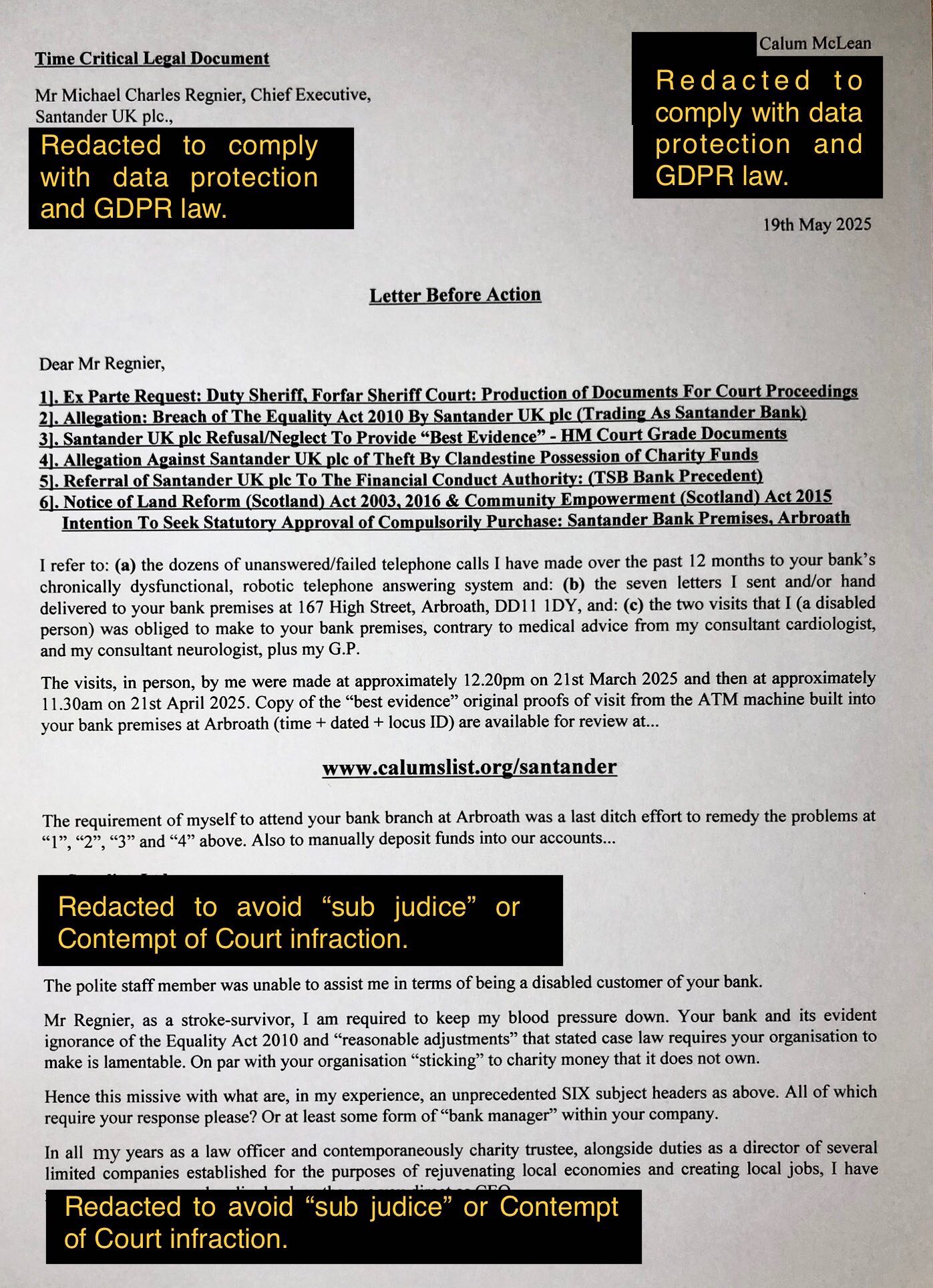

Mr Regnier, for the sake of transparency, here is the penultimate Letter Before Action in an effort to abide by the advice from our appearance as Pursuer in a different matter, but with the regular learned advice from the Sheriff (this is the term for Scottish judge)…

Judge to those at HM Court…

“Have both parties made best efforts to resolve matters between themselves, before coming before this court?”

In this specific Santander Bank case our summation is:-

“We as Pursuers seek: (a) the return of money belonging to the charity we founded in 1997 as retained by Santander Bank and: (b) the bank statements we have been deprived of (as held by Santander Bank) in order that we can honour our legal obligations to the Registrar at Companies House and file an accurate set of accounts.”

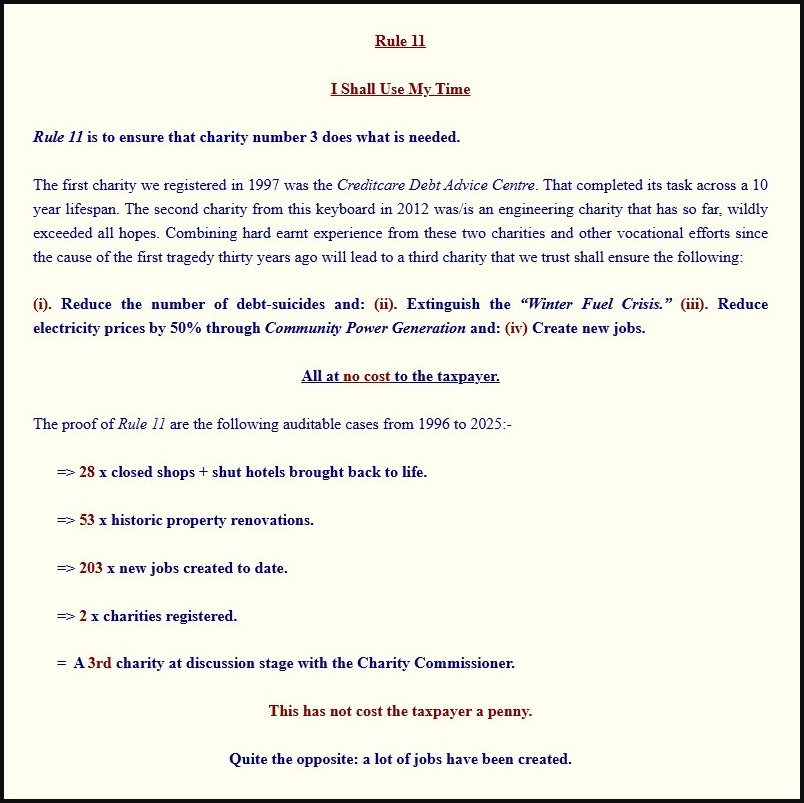

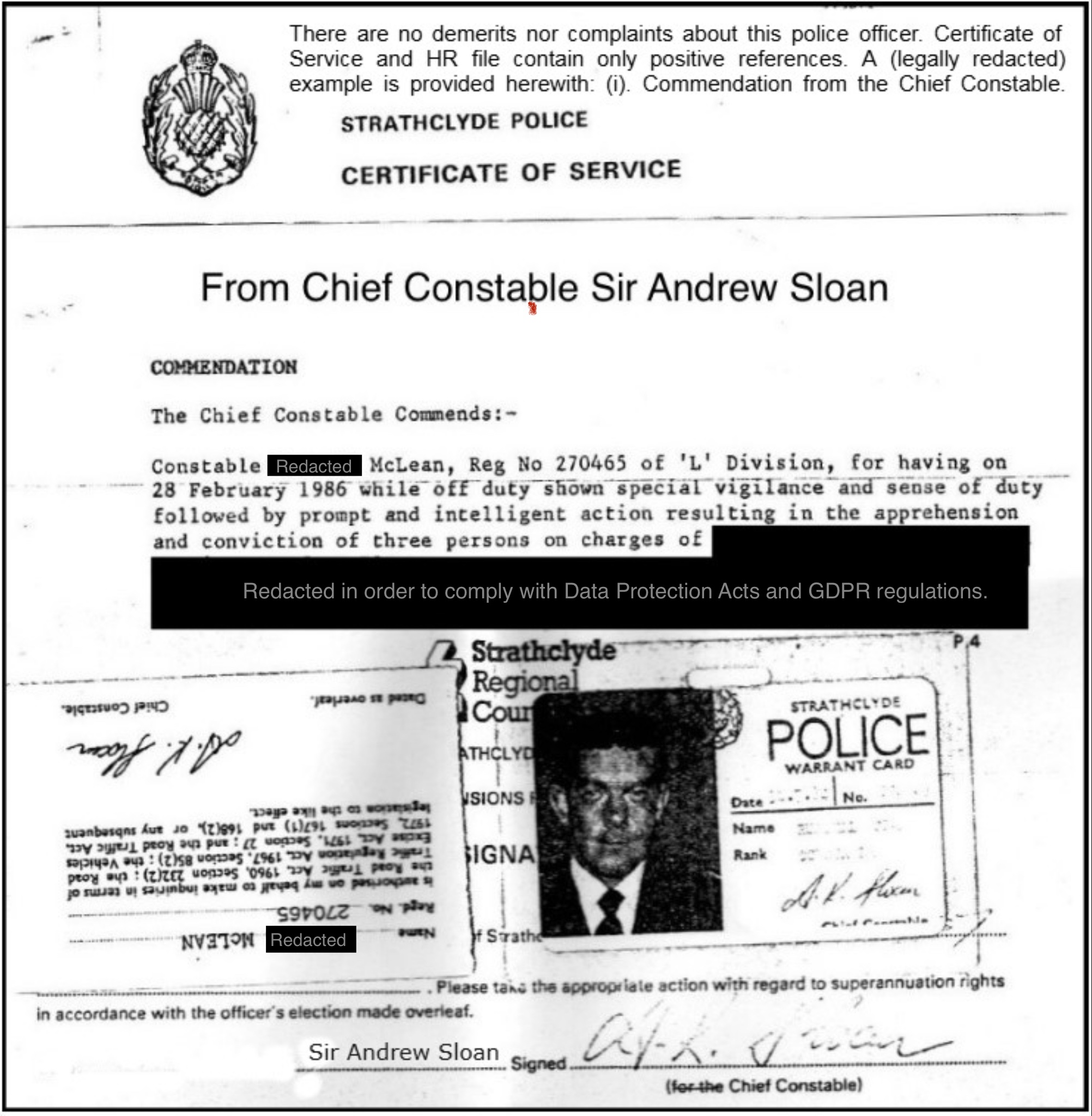

Now at the end of May 2025, following the advice of our legal counsel, we must REDACT the majority of what is on this letter. Further advice will likely require the removal of this document altogether. However, after 11 years mediating at our Creditcure Debt Advice charity (here), much of our free service to clients as a McKenzie Friend (here) and the honour of being allowed to address the Court on behalf of our indebted client as a formerly credentialed law officer (eg: here), it is important for us to let those reading this that best efforts have, indeed, been made to reach a mutually agreeable solution. In the case of Santander UK plc, no resolution outwith the formal HM Court environment seems possible.

^^ Apologies For The Redactions ^^

This Missive May Require Complete Removal Soon

As at 29th May 2025, 7 days after special overnight courier to the Santander CEO, in fact, no reply of any merit or significance other than “phone our (Santander) general enquiry line on 03309 123 123″ has been forthcoming.

***********

Pursuer’s Final Informal Effort To Defender

Progress In Resolving Matters

Mr Regnier, we have been trying to recover our Creditctare Debt Advice Association money deposited in your bank for over a DECADE.

Your bank still have our Creditcare Debt Advice Association funds.

Your bank have failed to provide any functional banking facility when it is needed by our debt advice association needs to pay the telephone bills and electricity etc.

Mr Regnier, have you no shame?

Our charity was registered in 1997 and we ran it for 11 years in total (as a registered charity). PTSD problems from earlier career and many death inquiries as a police officer burnt through much mental health reserves.

The deregistration process at 2007 was part of a closure effort.

Unfortunately the demand for debt advice was still apparent as local folk kept coming to our trustees in the street and at their place of work (a harbourmaster’s office of all places).

So we sorted out another, more appropriate office…

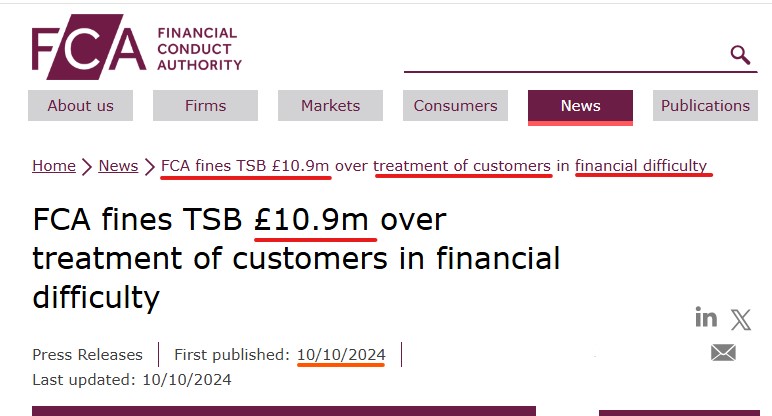

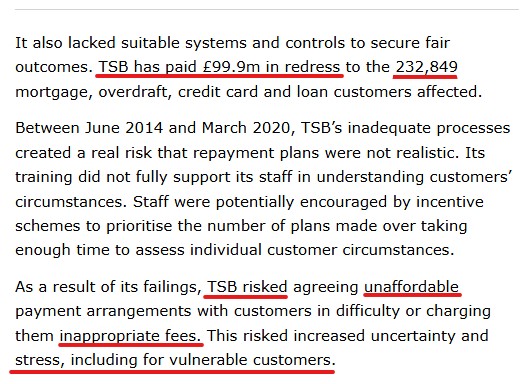

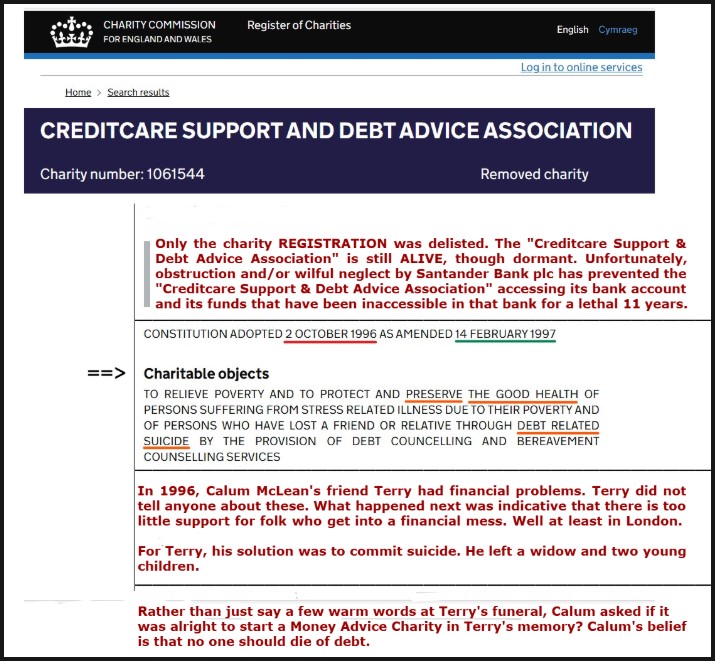

We also addressed the volunteer-burnout risks by additional and new volunteers (we included provision for mental health and stress monitoring). Why? Because several less reputable banks still issue dubiously lawful threatening letters of such a risky nature to life, that the Financial Conduct Authority (FCA) are already doing an excellent job with dysfunctional companies such as yours (here is what just happened at the TSB plc bank)…

Over £100,000,000

In Fines & Penalties

^^ TSB Fines & Penalties: Over £100,000,000 ^^

^^ Santander UK plc Should Really Self-Report To The FCA ^^

Source: FCA & TSB plc ~ Click Here

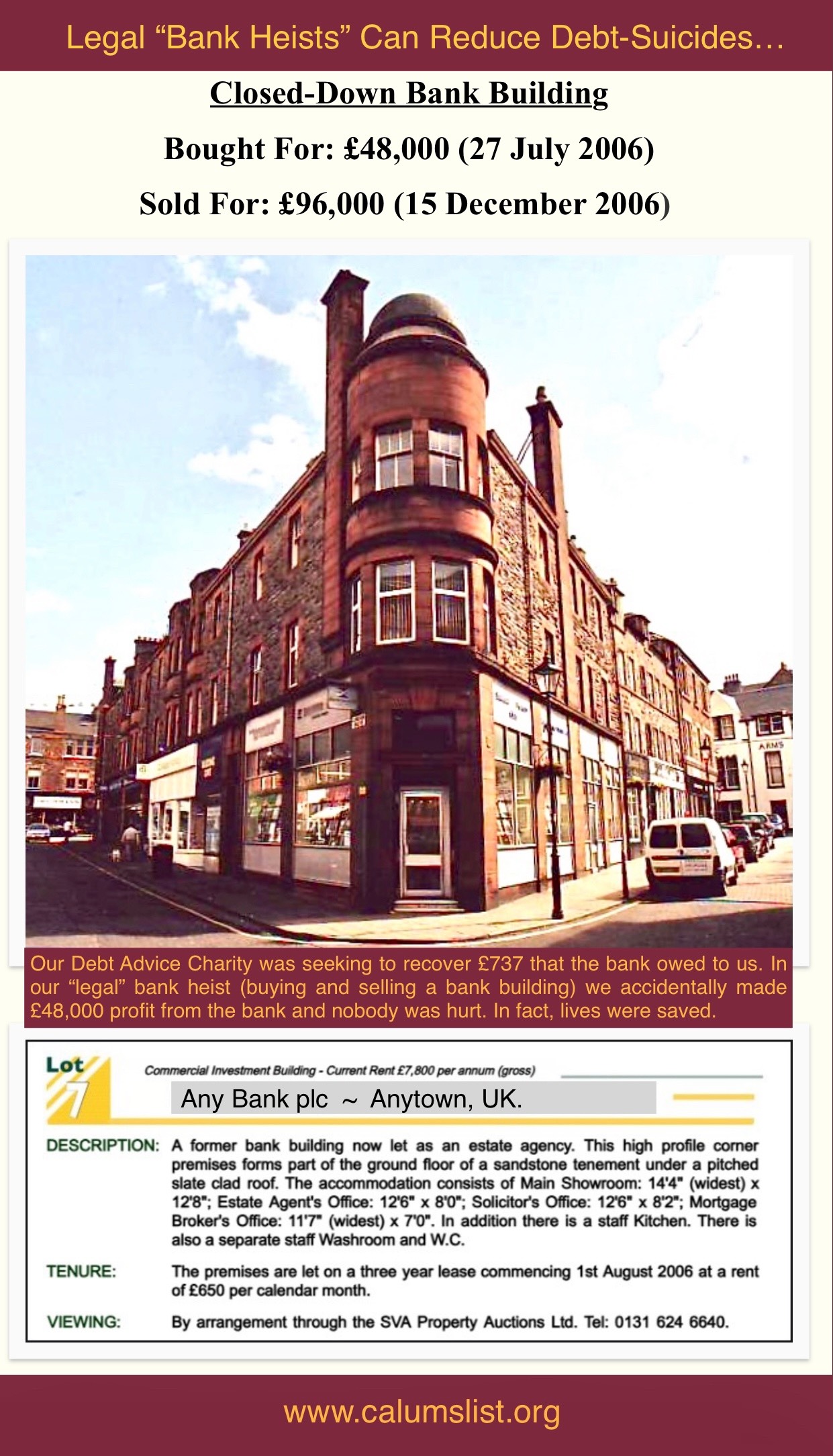

Our Creditcare Debt Advice Association still exists as a legal entity, albeit a not-for-profit association rather than fully fledged charity. Though after the legal “bank heist” and inbound £48,000, we are looking into the costs of re-registering as a formal charity.

Creditcare Debt Advice Association still EXITS. It is run by two former police officers. Neither of whom are happy that Santander Bank are being at best legally negligent and at worst obstructive or wilfully blind in respect of their (disabled) customers’ banking needs and the still live (in 2025) not-for-profit entity of Creditcare Support and Debt Advice Association…

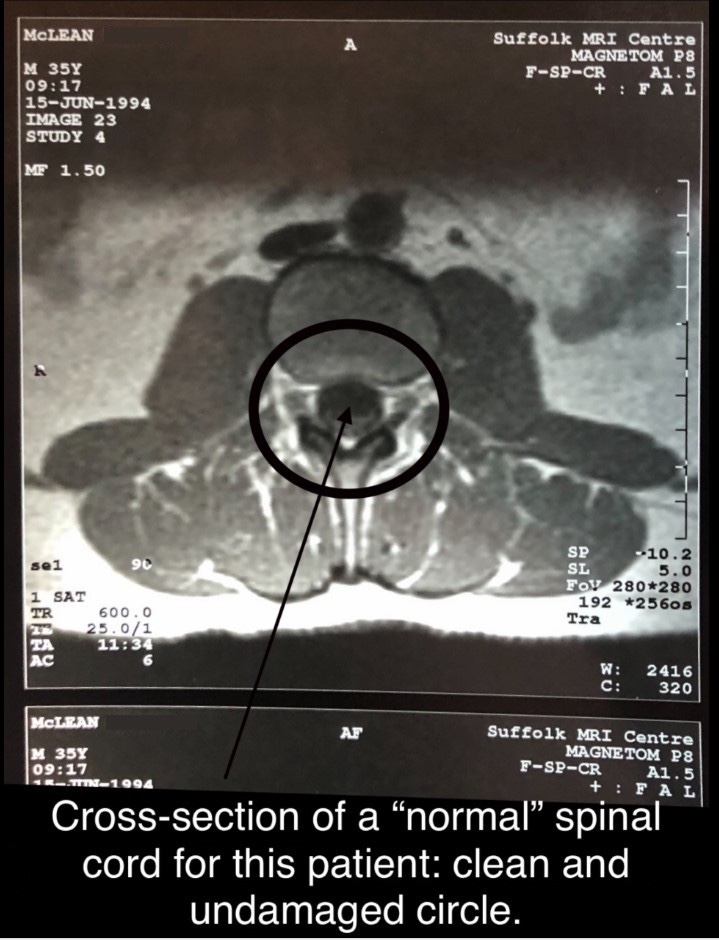

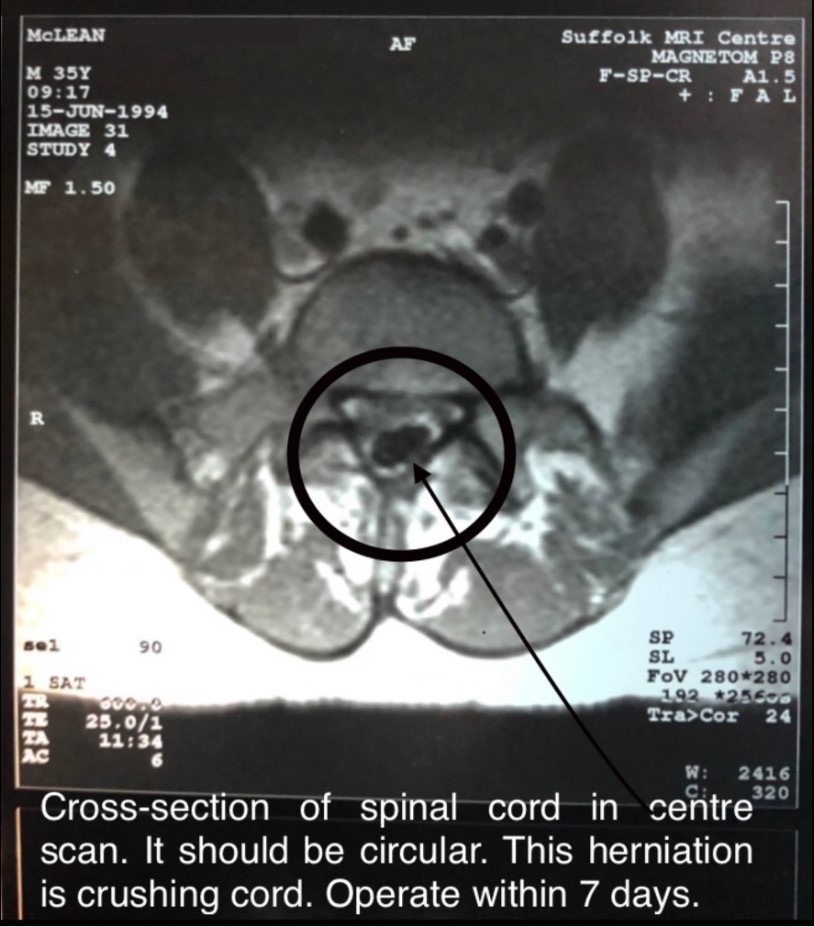

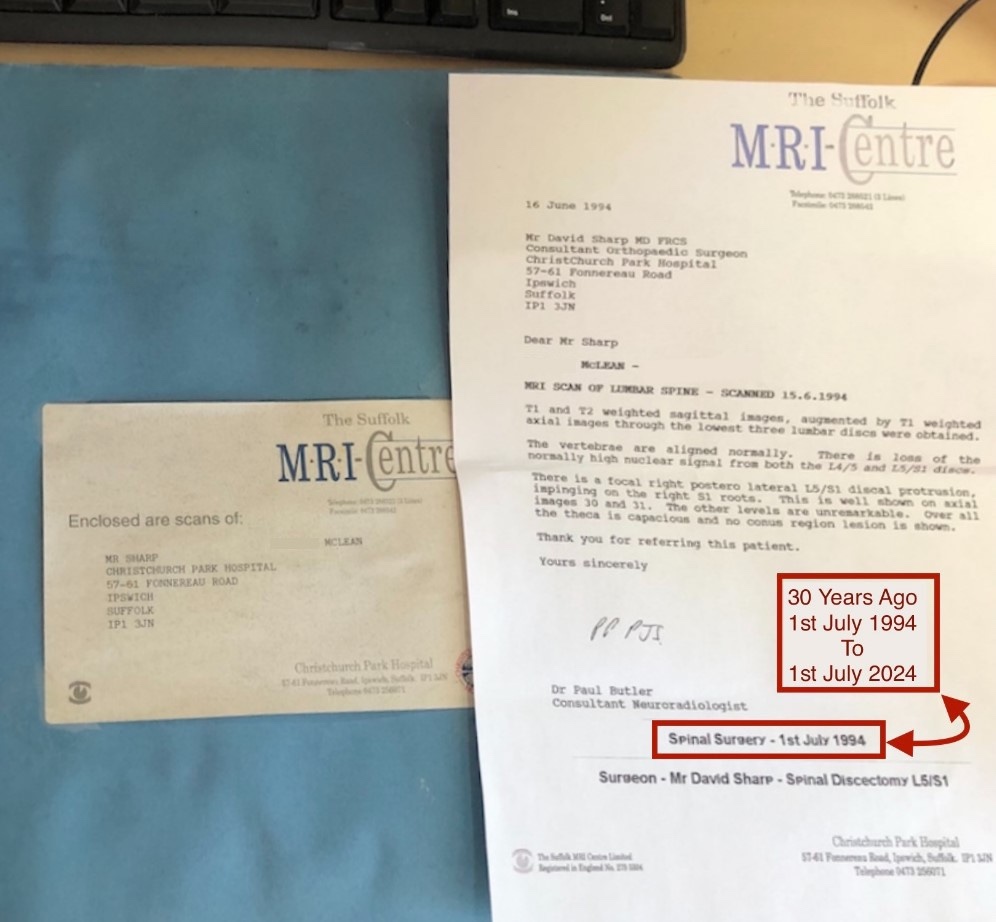

We have politely explained to Santander that our charity founder was injured on duty and after spinal surgery. Evidence…

Further evidence of physical disability….

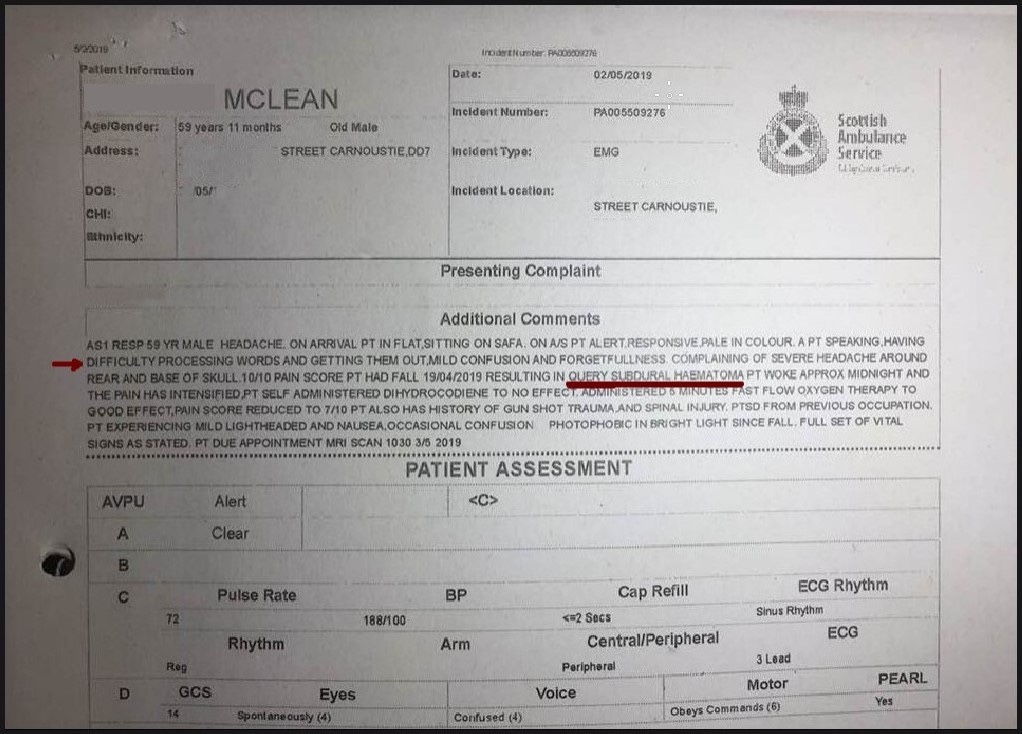

For FULL DISCLOSURE purposes to assist the nascent Defender (Santander UK plc) assess their position, the Pursuer (and founder of the 1997 Creditcare Debt Advice Association avers in law that he has further disability in the form of a stroke following being hit on the head by a 5,000 ton car ferry…

^^ Within Half An Hour of Boarding This Ferry ^^

^^ On 19th April 2019 ^^

^^ The Defender Had Suffered A Stroke ^^

Evidence for the public record…

^^ The Pursuer Has Ample Evidence That He Is A Stroke Survivor ^^

Yet Santander Bank do not care. They do not answer their phones; they have no disability liaison staff.

Have You Had A Brain Injury?

Do You Bank With Santander UK plc?

Then According To Santander Conduct: Tough Luck!

Even if you have recovered from the stroke enough to get back to work, don’t expect Santander UK plc to obey the law.

^^ Do Santander UK plc Care About Stroke Survivors? ^^

Thankfully, organisations such as Companies House DO have Disability Liaison Officers.

We commend the Registrar at Companies House.

The Registrar and her staff at Companies House have demonstrated an exceptionally good understanding of the difficulties that can sometimes beset a limited liability company director that has a disability, but still expresses a desire to continue working as a company director (with a modest amount of the “reasonable adjustments” mentioned in the Equality Act 2010).

One document our (pro bono) accountant was able to prepare summarised what disabled directors and trustees can manage if given just a little bit of empathy from official organisations…

^^ Official Organisations Such As Registers of Scotland ^^

^^ Plus HMRC & Companies House ^^

^^ Should Be Given Credit For Helping Disabled Directors ^^

Sadly, not all organisations realise that with a small amount of empathy, people with disabilities can produce jobs and liaise with contractors to enable High Streets come back to life (as an example).

Unfortunately n this case, Santander Bank have LOST the bank statements for at least THREE of the Pursuer’s job-creation and High Street Rescue companies.

We would recommend Mike Regnier, CEO of Santander UK plc go across to the Registers of Scotland (HM Land Registry, or the Registrar at Companies House and learn how to help companies create jobs!

Bank managers USED to do that. Not anymore.

Santander Bank are closing down their bank buildings to make their profits even vaster.

Mr Regnier, if you read the Land Reform Act + Community Empowerment Act, then you may find that closing the local Santander bank is, perhaps a little premature. Sheriff Niven-Smith at Dundee Sheriff Court just issued a precedent that seems to put justice front and centre.

Slightly tongue-in-cheek and as a nod to our first legal “bank heist,” the subject and law may seem very different, but the result is the same, our Rule 3 applies…

In this case, our legal advice is you can NOT sell your bank building if your company harms the local community. In Land reform and Community Empowerment law, you may well be forced to sell to a community banking hub!

^^ Bank Closures May Well Stop Under New Legal Precedent ^^

Mr Regnier, in fairness to Santander Bank, we understand your company SUPPORTS the new, community-owned banking hubs…

^^ Santander Bank Might Just Be Able To Redeem Their Company ^^

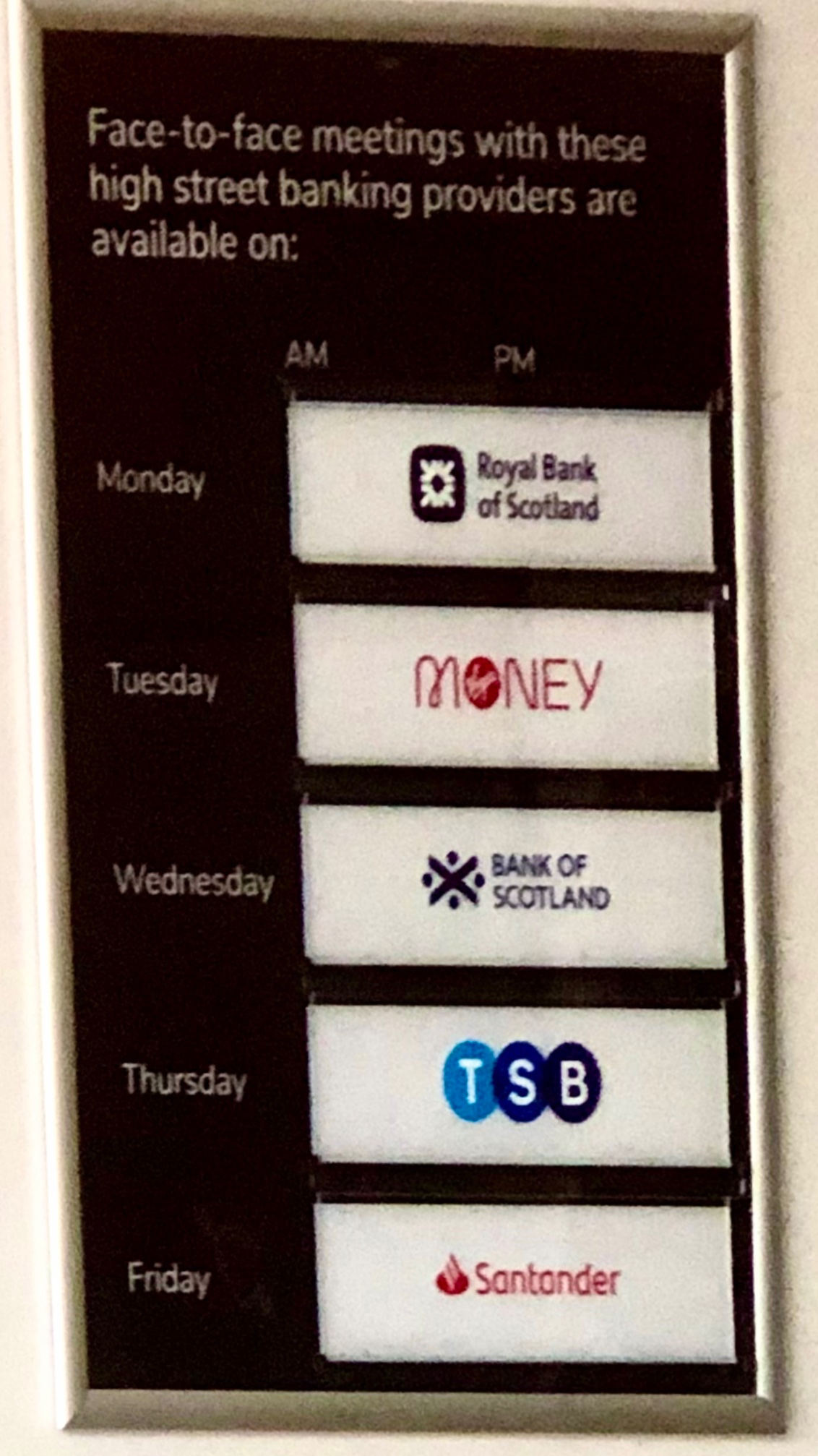

Santander does, it seems, support the very elegant solution to bank closures…

Sharing Bank Between FIVE Banks & A Post Office

We Will Be Adding A Free Debt Advice Office To The Mix

^^ The New Generation of “Banking Hubs” ^^

Whether Mr Regnier at Santander UK plc “gets the point” of this, or not, we will be buying old, closed bank buildings. We have before and will do again.

We would be thrilled if Santander Bank worked WITH us and organisations that provide free debt advice.

It is exhausting to fight (especially for stroke survivors with post-stroke-fatigue hitting at around 3 pm in the afternoon).

Far, far better for CAB type debt counsellors and banks to work together.

Yes we understand why banks want to close their buildings.

The best hybrid are shared “Banking Hubs”.

We have the resources at Calum’s List to make that happen all across the UK.

It would be so much better if the banks saw the benefit of helping debt advice charities, all of who provide FREE support to HELP the BANK CUSTOMERS repay their loans!

As for Santander Bank keeping charity money for a decade. That, we find is very close to “theft by clandestine possession.”

With regard to Santander Bank closing down business accounts for this disabled person’s job creating business centres. That is a disgrace.

As for Santander Bank closing the bank account for this customer’s hotel renovation project that has been 90% renovated through the pandemic.

If there was bad debt or problems, perhaps. But we OWN 100% of our buildings. Bank mortgages have been BANNED by us. We have NO debt. Why? Because banks cause people to kill themselves (here).

We have plenty of positive cashflow.

Even when the “dormant” account went £24 overdrawn by cause of monthly bank fees, the disabled director on this page, pursuing Santander UK plc travelled to the branch in person (Santander online banking doesn’t work) He called into the Santander Bank, (against medical advice) and tried to deposit £100 so that the account was properly in credit. Frustratingly, the Santander “computer said no.”

Santander’s CEO and directors really need to sort themselves out or consider their position

Mr Regnier, there will be a new generation of…

Community Owned Banking Hubs

Why?

Calum’s List mantra of…

If Mr Regnier and Santander Bank ignore this plea, then that’s up to him. He can explain to the FCA how his company’s (alleged) conduct caused breaches in the Equality Act and several other statutes.

We are content to assist…

The New FCA Regulator Is Doing An Excellent Job

Just ask the Board of Directors and CEO & Chairperson at TSB Bank plc and their

£100,000,000 in fines and penalties…

^^ Th Era of Banks Greed Over Customer Safety Is Over ^^

A gentle warning of £100,000,000 in fines and penalties at TSB plc is a fair warning for starters…

As for the nascent risk of gross negligence manslaughter? Over to you Mr Regnier.

Playing Russian Roulette with your customers, many of whom you now know have survived a stroke should have you wisely consulting with legal counsel about who exactly te statutory “directing mind” in terms of HSE statute serves that responsibility at Santander UK plc trading as Santander Bank?

Be in no doubt now Mr Regnier, you and your Board of executive and non-executive directors would be well advised to consider their legal position when causing stroke survivors to go into hypertensive crisis because you refuse or neglect to repay the charity (now a not-for-profit association) back its money?

***********

Credentials

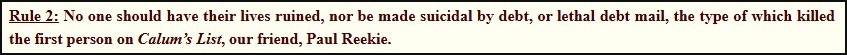

We have been asked to present “credential” and “bona fides” along with “evidence.” In order to comply, here is the commencement of that set of documents. For fairly obvious reasons, the original source required REDACTION.

Idntification

In order that the nascent Defender and his company can see the face of the nascent Pursuer, here is evidence that speaks to both ID and earlier career bona fides…

^^ Full Disclosure: The Pursuer (Scots Law Term ~ Civil Law) ^^

In fairness to Santander UK plc., the transparency issue is important and the Pursuer has consented to this.

***********

Summary

1]. The disabled customer (and charity founder) needs a local bank to visit (as the Santander online system does not work on his computer without repeatedly failing and).

2]. Santander have repeatedly IGNORED the legal requirements of the Equality Act 2010 and the customer as a director (of three job creation limited liability companies that held bank accounts withs Santander, al accounts now CLOSED by Santander).

3]. Plus, Calum McLean as Pursuer and trustee of the Creditcare Debt Advice Association requests the Defender make “reasonable adjustments” in their systems… to enable a disabled person to serve a meaningful life, including run a charity and/or not-for -profit association.

4]. Santander U.K. plc Head Office announced they are closing the local (Arbroath) branch. In spite of protests by disabled members and other members of the local community that they cannot access their Santander bank accounts online and the Santander telephone answering system is dysfunctional and diabolical.

5]. All of which means disabled and vulnerable people are being left without access to their bank accounts.

6]. The local community alleges this will cause “harm” to the local community… including bank staff losing their jobs, or at best being redeployed to a far away place.

7]. In terms of the Sheriff Niven-Smith ruling at Dundee Sheriff Court in respect of another party seeking precedent via an appeal on earlier judgement in terms of the Land Reform (Scotland) Act 2016, a very helpful and clear precedent in law has been set.

8]. Consequently on another case at a different location, though in the same Sheriffdom, the subscribers’ to Calum’s List website have received counsel from their Advocate (Scottish Barrister), that this appears to meet the threshold of infraction to seek a ruling from the duty sheriff at Forfar Sheriff Court on whether Santander U.K. plc as defender, may have infracted the “harm” statute within the under noted laws…

=> Land Reform (Scotland) Act 2003

=> Land Reform (Scotland) Act 2016

=> Community Empowerment (Scotland) Act 2015

.Please check back to our front page soon for an update. Thank you.

***********

Next Phase

Because of the legal precedent set by Sheriff Niven-Smith at the Court of Appeal, our own counsel (pro bono K.C), advises to remove the content of this page. In the oft used expression…

“If you know, you know”

Having spent thousands of hours in court, the subscribers of this website, of whom 8 of the 11 are law officers or retired law officers, know that the majority of justices prefer best efforts are made between pursuer and defender at resolving their difference by mutual agreement, rather than appear at court and take up valuable time.

So to whomsoever at Santander Bank that may read this, we respectfully suggest you get in touch with one of our team… you know, the trustees of the debt-advice-charity from whom you deprived funds. Also described as “theft by clandestine possession.”

***********

To get in touch with Calum’s List” ~ Click Here

To See The House of Commons penultimate video: Click Here

To return to the website front page: Click Here

***********

.

.