This website was registered on 8th March 2012 and is a memorial for 60 of our friends who died from suicide or other lethal means where debt and the cost of living became too much.

We Are Moving Offices In October/November 2025

So The Latest Updates Are Temporarily Suspended

***********

Back to…

Calum’s List: Under New Custodianship

People Should Not Die of Debt

We Now Aim To Reduce Debt Suicide

First, That Earlier “Bank Heist” Explained…

Chapter 1

On The New Calum’s List Website

Please do NOT try this “bank heist” remedy at home. The new custodians of this website have experience in bank heists. Not as criminals, but as cops…

We Have A Different & Legal Solution

That Is Better Than A Bank Heist

Photo of Jackie & Calum In 1983.

^^ Calum Has Some Obvious Legal Training ^^

& “Yes” The Uniform & Credentials Are Real: Here.

Though we cannot recall there being law lectures at police college on bank heists a term coined by one of our money advice charity clients (here).

Please do not do bank heists yourself, no matter how slithery the bank bosses at keeping charity money which does not belong to them.

=> Also, we do not recommend Santander Bank plc as a place where we would look to keep charity funds safe!

Actually, the new HM Court ruling by Sheriff Niven-Smith may make our local Santander bank building safe (the term sheriff means a “judge” in Scottish vernacular).

Our Advocate (generally the Scottish term for a barrister) is reading the fine detail of sheriff Niven-Smith’s ruling.

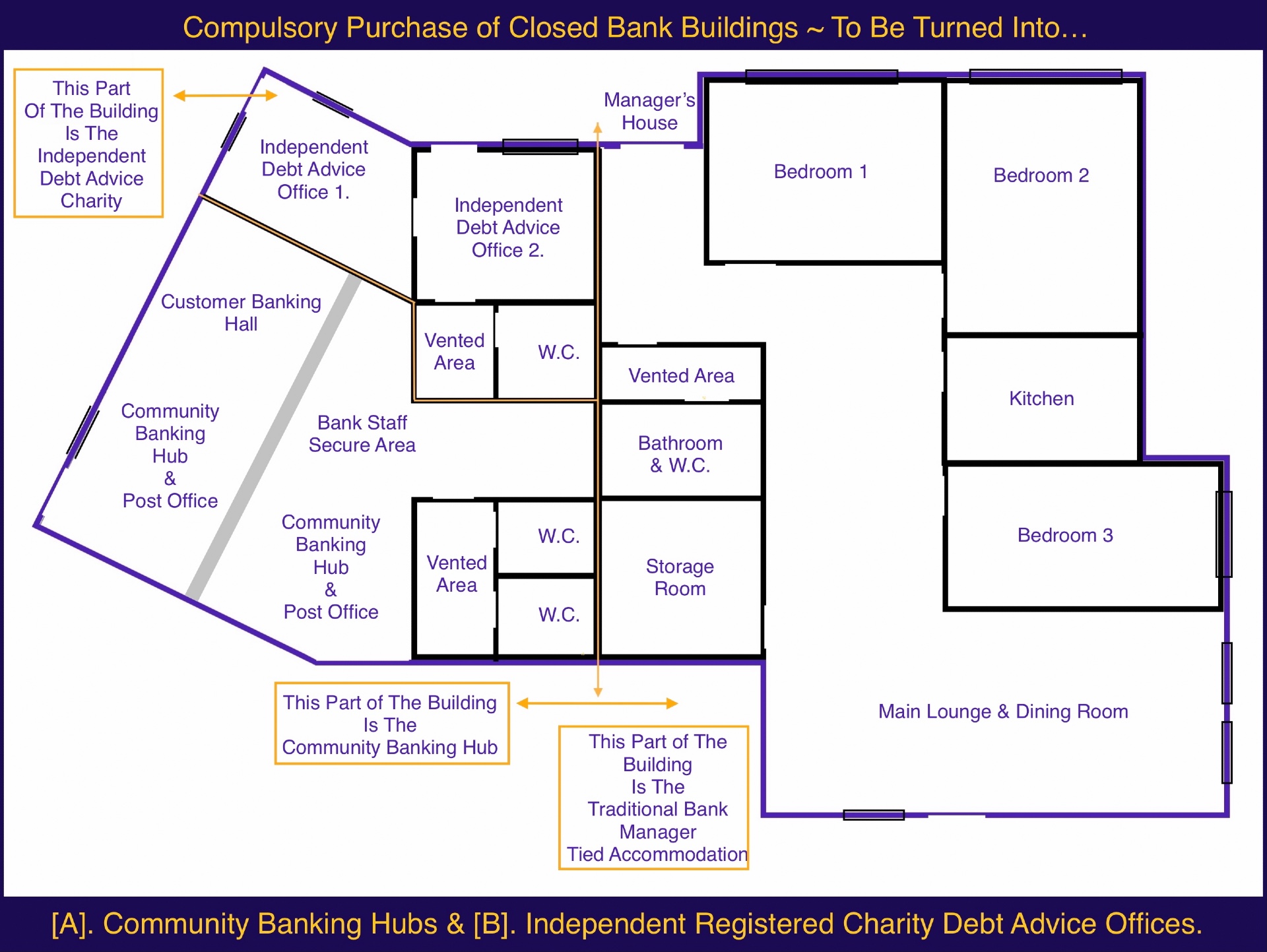

=> We appear, in certain circumstances, to have a right to seek a form of compulsory purchase of the Santander Bank building at Arbroath, if “harm” (financial or disability) is caused by a bank closure to the local community.

Well, well, well… a different form of bank heist. Also very legal!

Imagine a local community having legal remedy to repossess a bank building, and preserve jobs + local banking amenity?

Our Bank May Have Our Charity Funds Locked Away From Us

But We Seem To Have Discovered A Legal Key

To Repossessing Recalcitrant Bank Boss' Buildings!

The “land” may look very different, but whether it is a land-banked bank building, built on a piece of land (click here) or a piece of derelict land, there is one thing in common: both have the word “land” within the legal matter.

Source: Preliminary ruling: Click Here.

Formal ruling: Click Here.

Additional legal empowerment: Click Here.

***********

One Last Attempt To Get Santander Bank To Play Well With Others

& Not Be So Greedy

Dear Mark Regnier, CEO of Santander UK plc,

We hope you will come out an play nice.

Please give the charity (now a not-for-profit association ) it’s money back.

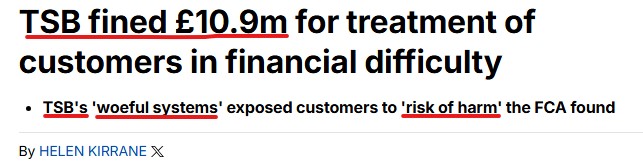

Thankyou for being such an Amadan. Your Santander Bank management have frustrated us so much, we will be registering a new charity so that if the banks in general do not play nice, they will get whacking great, eye-watering fines and civil penalties like your pals across at TSB plc. Ouch.

***********

Seriously, We Do Mean: “Ouch” For The Banks In Pain!

It is almost possible to feel sorry for the banks. But Santander Bank plc have ignored disabled customers begging for help to access charity accounts. So not much sympathy. This is what happens when banks in general get too greedy and take customers for granted…

Full TSB £110,000,000 Fine & Compensation To Customer ~ Article: Click Here & Archived Here.

Official Source From The Magnificent Financial Conduct Authority: Click Here.

***********

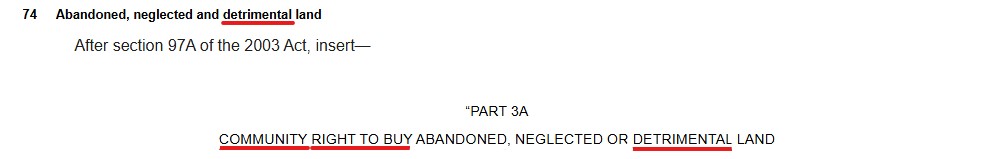

The Letter of The Law & More

In the meantime, our Advocate (Scottish Barrister) just sent us these clippings. Even mere mortals such as Calum the computer dinosaur may understand what this means? Our barrister put a note on the message. She simply wrote…

“Here is the letter of the law. Extra law in case the new Dundee precedent is found to be weak in respect of bank buildings compared to Poet’s Neuk!”

Official source: Click Here.

***********

Hope For We Mere Mortals Does Exist

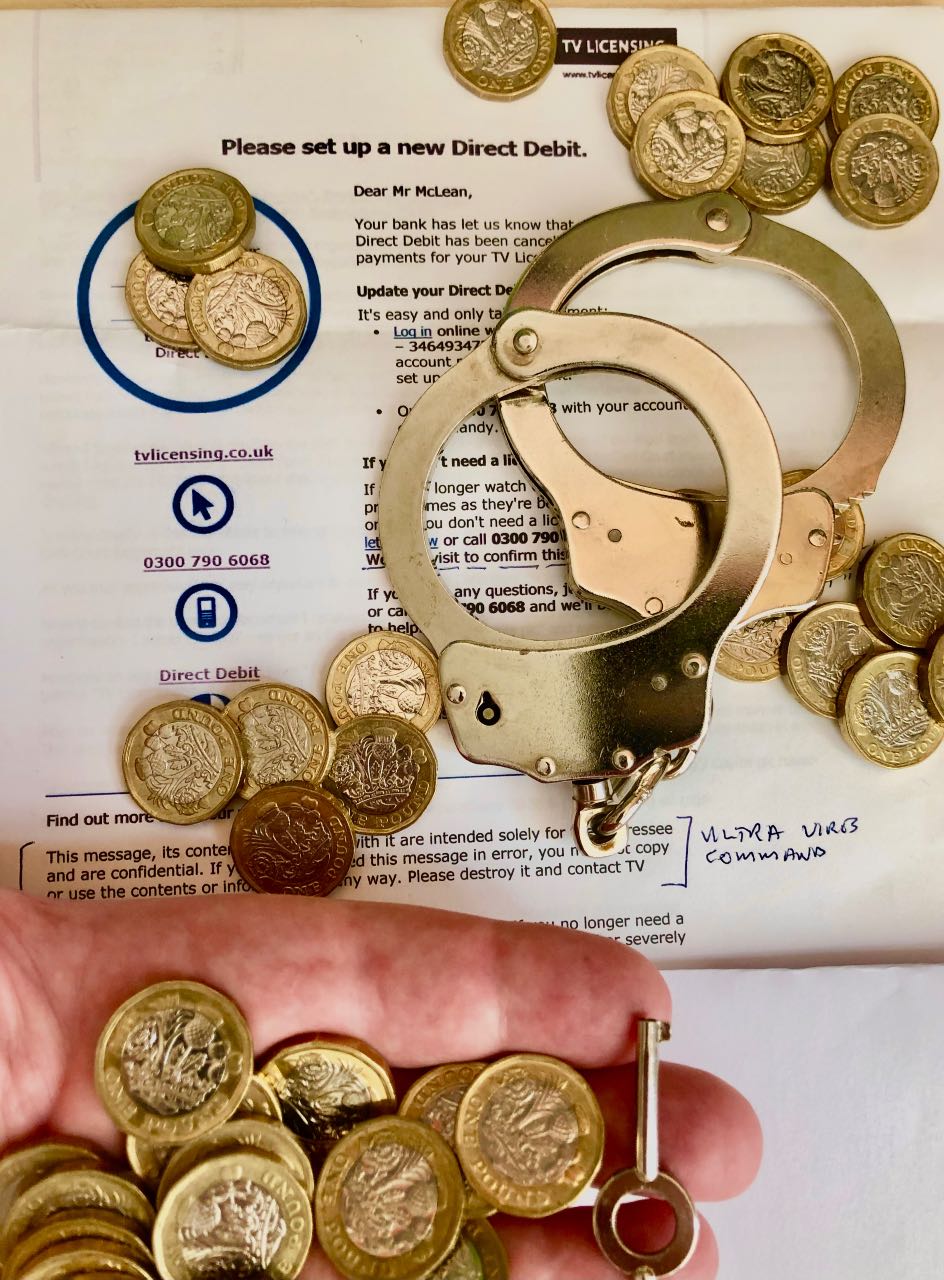

The first “bank heist” was actually a proper and fully legal process. It netted £48,000 for the debt-advice association (the charity that we originally established in 1996/1997). We will forensically detail the “bank heist” in due course. But first we need to focus on the most important matter here and now…

=> Possibly you or one of your family/friends are up the financial crap creek without a paddle?

That may seem a bland and blunt thing to write. Perhaps their credit rating may have taken a dent? Maybe they seem a little stressed about the electricity bill?

But here’s the thing: the cop that got pulled into this website in 2011 did so because that year, 15 years after the first debt-suicide happened, he lost a second friend to money nightmares.

Money? Life should never be lost to debt. Never.

Especially when there are so many solutions to sort out and extinguish debt problems.

You could start a charity like the one we mentioned. It lifts our teams morale to an incredibly happy level each time a good result is secured (for both borrower and lender).

Or, if you fancy, just get the kettle on, make a cup of coffee and settle down to read this page and watch an awesome video by a heroic Welshman, Michael Sheen saving the lives of people in debt (Michael does not yet know he is doing that, but we are about to let him know).

^^ (c) Channel 4 & Michael Sheen ^^

One of The Most Important Documentaries Ever Made.

This will be available after this article….

Here at Calum’s List, we were blown away with what Michael did to the point it would be an honour if he accepts an invitation to be the new charity patron.

That first debt-suicide Calum encountered was in 1996. Instead of just warm words to a widow and two young children who had just lost their Dad, our friend’s widow was asked if we could start a charity to make best efforts at reducing debt-suicide.

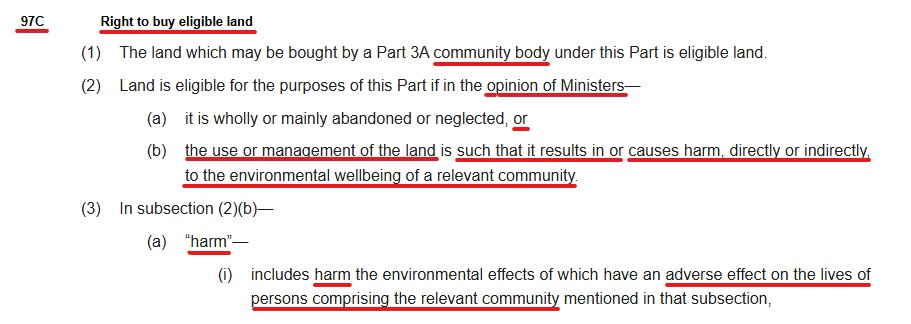

Debt Can Feel Inescapable For Some Folk

^^ The Handcuffs Are Real: So Is The Metaphorical Debt Release Key ^^

Many of us never really know how serious these debt issues are until one of the worst things in the world happens. We have actually heard these words…

“Could I have done something more for my sister before she died?

After a tragedy that changes your world utterly and forever, it can feel too late to ask yourself that sort of question.

But it needn’t be.

Not if we do something before a “permanent solution to a temporary problem” takes the life of someone whom we care about.

When Mick Moore started this “Calum’s List” website, the name was an accident. One of the alternate names it was supposed to be called the “Welfare Reform Death List”. Not too inspirational. But things were different 15 years ago.

Back then in 2007 Mick (being an older gentleman) had miraculously mastered the internet sufficiently to get his own DWP-Disability-Exam-Help website up and running (and helping thousands of disabled people).

Sadly, Mick is now dead, and short of finding a working Ouija Board, we will never now know why Mick registered this website (in 2012) as “Calum’s List.” That happened long before Calum realised the chain of events back in 2011/2012. Now (here) and then (here from here).

Besides the first friend Calum lost was due to money problems in general. That was how the Creditcare Support And Debt Advice Association was born (here). We kept the charity registration alive for 10 years. But because of PTSD the main trustee of the charity was struggling beyond a safe point. So we tried to close the legal entity (Creditcare Support And Debt Advice Association). But being in a small community, folk would just (bizarrely) visit the harbourmaster’s office for their debt advice because “that was where the bloke that sorts out debt matters works!” So to this day, 4th May 2025, the Creditcare Support And Debt Advice Association still legally exists.

However Having Folk Visit A Habourmaster For Debt Advice

May Be Small-Community Quaint But It Is Not Professional!

^^ Harbourmaster Just Said Goodbye To Ship’s Master ^^

Photo By Timothy Smith. Alamy Fee Paid: Here

After he lost his job in the police through disability, Calum was harbourmaster here. Every Wednesday afternoon he plus two shoreside crew would catch the heaving lines and bring the paddle steamer Waverley in to her berth at the pier.

A growing number of local folk would know this was where to find the “debt advice bloke” and randomly turn up at the harbourmaster’s office on a Wednesday!

^^ Paddle Steamer Waverley ^^

^^ Ropes Just Let Go By Harbourmaster McLean ^^

Photo By Calum McLean: He Has Open Sourced His Licence: Here

So around 2006 a couple of things happened. Firstly the charity’s bank were abominable and would not let the trustees access the £737 in the charity account. That was bad enough, but the charity had nowhere to put the inbound funds to keep the free debt advice phone line connected!

The second thing that happened, and please forgive any comedic element. It’s a sort of Billy Connolly stress release mechanism. A lady wanders into the harbourmaster’s office (this is absolutely true). She asked “if the debt advice man was in?”

Calum McLean chirped up in reply… “That would be me, guilty as charged, please have a seat.” The lady had just been subject to an internet scam. Her bank account had been drained by a phishing conman (over a thousand pounds) and she couldn’t meet her rent. Calum asked if she was hurt or needed any medical attention. All OK on that front. Just the rent payment worry. Calum then asked if the lady (who had lost her money) knew the phishing person (it was early internet days).

The lady said she thought the bad man who scammed her bank account was a Nigerian General.

Calum asked if she saw the man, perhaps she knew what he looked like? The words of reply were unexpected…

I think he looked like you.

What do you mean was the bewildered answer!

Well you have a uniform that looks like a Nigerian General.

At this point the realisation was… quaint or otherwise… the harbourmaster’s office was not a suitable venue for a money advice association.

So the (separate) company operated by Calum and friends sponsored some office space at the other end of the harbour building and donated a rent-free office to the charity. But local folk would still head for the harbourmaster when he was on the pier and ask for help.

There was an evident need for money advice and the nearest CAB was 80 miles away from the local 6,000 town + 6,000 rural population.

This is when the “bank heist” happened.

The group of friends who started the money advice charity in 1996/1997 saw an empty bank building for sale near to the harbour (we are now at 2006). The old bank property had been closed down (as many are) for years. Fortunately, it was at a bargain price and even better it had the exact planning permission needed by the charity (debt-suicides happen at least daily in the UK so time is always of the essence and planning permission can take months).

There was something poetic about the fact that an old bank building could house a charity which was established to help sort out debt problems in which some folk found themselves. Much of that debt caused by banks – as Michael Sheen shall explain when he gives away £100,000 of his own money.

So the friends who had started the charity in 1996/1997, clubbed together some of their spare savings and bought this place…

^^ Back In 2006 We Sliced Off An Office For The Charity ^^

^^ & Put The Rest of The Building Into A Property Auction ^^

Please forgive the extra "meme" type additions to the photo above.

We are getting ready for a major roll out of buying

closed-down bank buildings across the UK.

The outcome was very interesting. It was also legal in every sense. Not so much a “bank heist,” more of a safe harbour for folk up the financial crap creek.

That helped a lot, on so many levels. But there is more to come, and not so much bank-heists, more like karma for those banks that play badly.

Instead the Creditcare Debt Advice Association has found a way, in 2025, to…

Repossess Bank Buildings!

We are waiting for the Sheriff (Scottish judge) to hear a case on appeal before we can comment any further. Though the lawyers say we can mention a friendly charity that has raised the action of legal principle and already won the original case. So the appeal needs to be very solid to reverse an earlier court’s ruling.

More news on justice for banks soon.

***********

.

A New Form of Bank Job!

Our resident legal beagle has smiled often when recalling one of our clients when she described the 2006 Creditcare’s fundraising + office locating as a “bank heist.” This has echoed down the years to almost a decade further on.

Those words resurfaced during an entirely random conversation about premises for a third charity.

Long story short, there is an obscure but new law that makes it legal for: “a community harmed by a bank branch closure” to seek statutory compulsion against the bank if they do not co-operate in selling the closed/closing branch to the local community.

So maybe watch out for a local community near to you “repossessing” a closed-down bank or even one threatened with closure…

^^ Now In 2025 There Is A New Form of “Legal “Bank Heist”

^^ We Are Forming Charity Number 3 For This Purpose ^^

Again, please forgive the extra "meme" type additions to the photo above.

We are getting ready for a major roll out of buying

closed-down bank buildings across the UK.

We are still discussing appropriate names with the charity Commission (it will NOT have the name Calum anywhere near it thank you)!

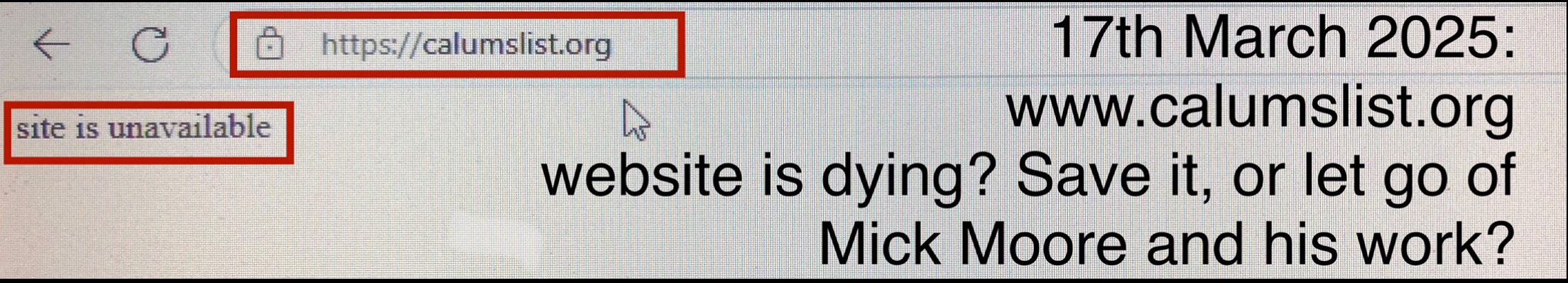

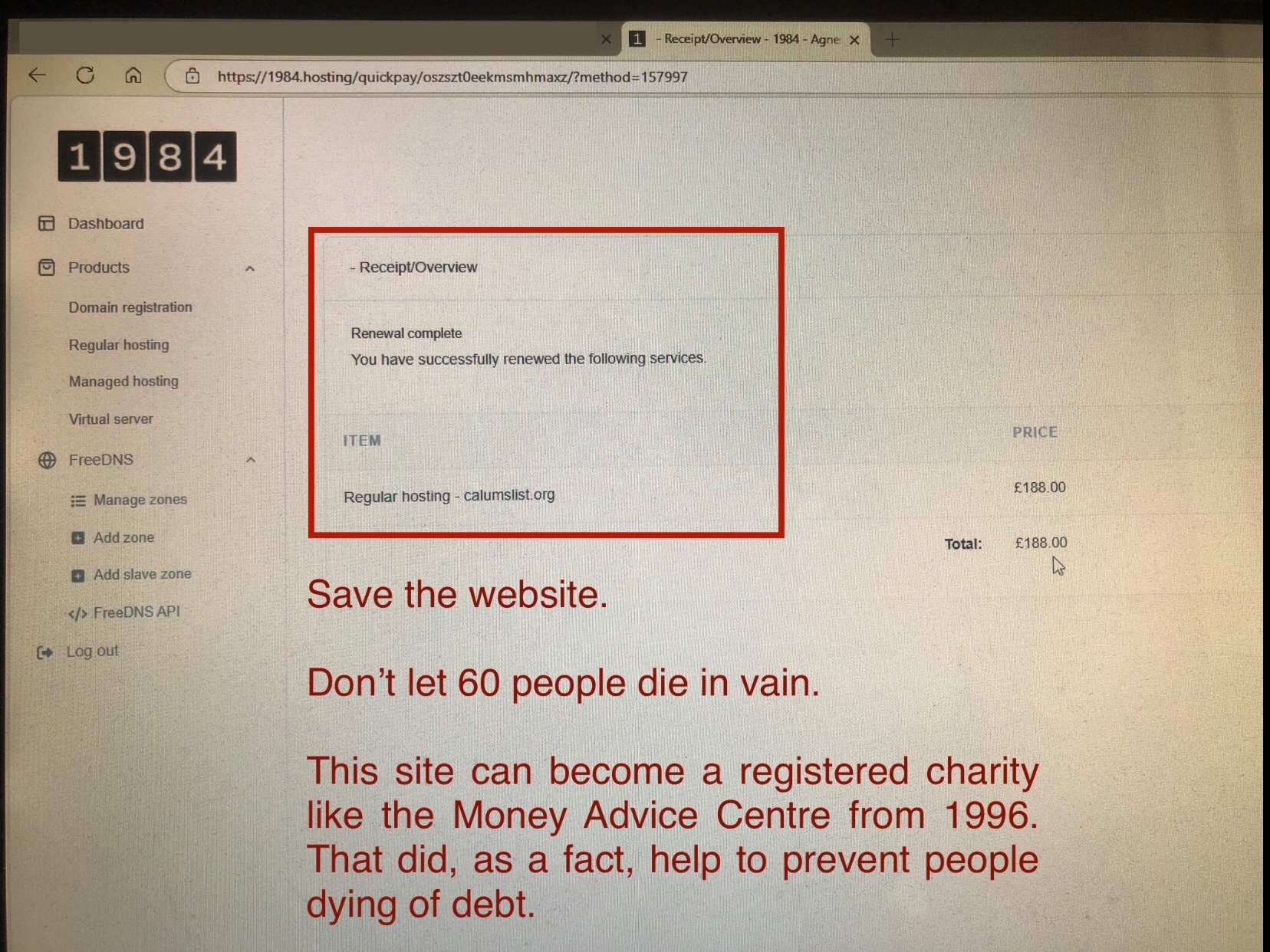

All of this is part of the reason the Calum’s List website has been saved from closure…

Creating a network of debt-advice centres all across the UK is the best way we know to honour those 60 folk who died and for which this website was created.

Mick and a group of admins from his DWP-Help website soldiered on for years trying to help reduce the tragedies.

^^ Disabled People Demonstrated. A Lot ^^

Calum's List - Photo Courtesy of Julia Modern & DPAC. Here

But we got nowhere.

Want To Reduce Debt Suicide?

Politicians Not Helping? Yet!

Well…

Accidentally Being A Millionaire Helps.

Then there was that £48,000 “bank heist.” It didn’t relate to this website as the Creditcare Debt-Advice charity was supposed to be winding down, not getting busier.

But here’s the thing. Calum was already managing to keep a promise born out of being a thrawn Glaswegian, when a feckless human resources manager at Strathclyde Police, Pitt Street HQ told him he was “not fit to be a cop through becoming disabled” and “best get used to benefits and the new daytime television” (it was the 1990s).

“Aye Right” was his polite reply

“Aye Right” means fuck-off in Scottish.

Thrawn is more useful in our context

The thrawn result at losing a coply career he thoroughly enjoyed could gone in one of two ways. Either pickling the old liver a decent bottle of high quality Springbank Malt (here)…

^^ The Distillery Laboratory Was Next Door To Officer McLean’s House ^^

^^ Temptation Seldom Gets Closer! ^^

Given that PC McLean was one of the only non-drinking cops in the Strathclyde Police service, the result was not to overly imbibe one of the finest malts in the world.

Instead he channelled the newly found anger at losing a job through becoming injured and disabled into creating jobs.

Why?

To prove to a feckless Human Resources manager who told Calum he was “unemployable” as a cop that she was utterly useless at her job. The irony, 30 years later being this: 203 jobs from an “unemployable” disabled person.

^^ The Credentials & Documents Proving This Will ^^ ^^ Form A Major Part of This Website ^^ ^^ & The New Spin-Off Charity That Is Being Registered ^^

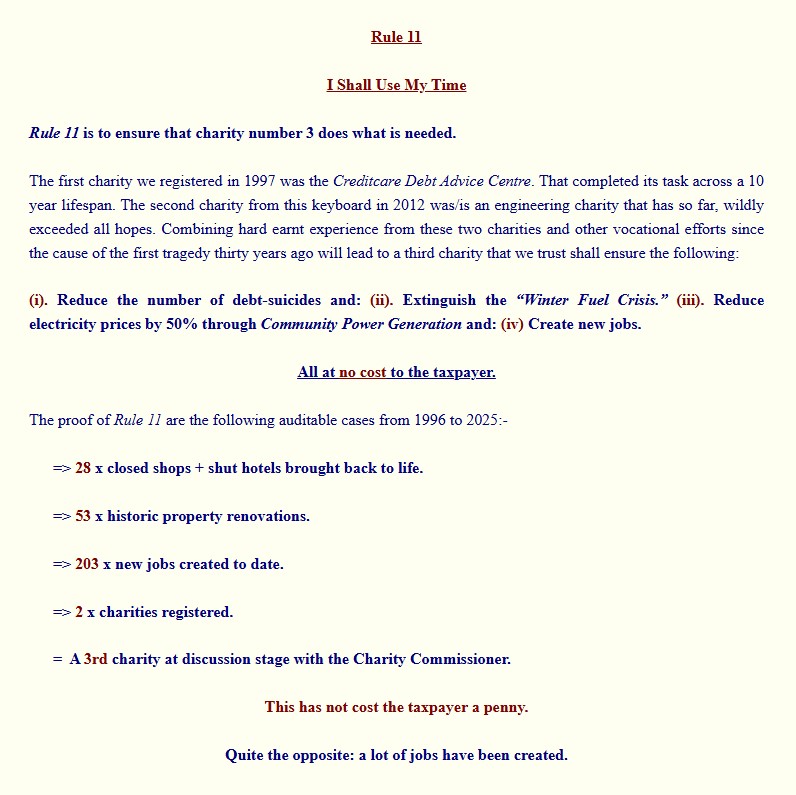

Why does that “Rule 11″ excerpt above have any relevance to my worries about money problems?

Well we tried campaigning for 20 years to help reduce debt-suicide. We campaigned for 11 years to stop welfare-reform-deaths.

Seriously, we REALLY tried the diplomatic political way.

If you have any doubt that we took this as far as we could, right up to the very top – with a lot of help from friends (we all become disabled, think about that please). Fortunately, when disability hits you, if you survive, you often develop skills and strengths you never knew were within you.

=> So when a group of disabled people join together and help each other to help everyone else, this final political moment happens…

If the politician who became shadow Chancellor of the Exchequer was unable to help us reduce debt suicide (nor welfare reform suicides) then we are on our own.

Seriously! What do you think of this? We are asking a real question!

^^ It Is Time For Disabled People To Help The Politicians ^^

Original Parliamentary Hansard Source: Here

If such a senior politician cannot help reduce debt-suicide, then we best “park” the politics and find another way.

Why? Because our 1997 Creditcare money advice charity research revealed that in 1998, a terrible total of at least 404 people a year committed debt~suicide (source from HM Coroners and Procurators Fiscal).

=> That means a family loses a loved one each day.

So time is of the essence.

***********

The Answer?

Well We Have Several.

The Government Needs Some Disabled Millionaires

To Help People Stop Killing Themselves Over Debt Worries

But there are many moving parts to helping HM Government sort out the horrendous death rate from debt. In short, our solutions are…

1]. To provide a free debt advice centre in every town and village across the U.K., where a bank seeks to close their building and when a local community expresses their desire to take ownership of the vacated bank building. Replacing the departing bank by one of the new “Community Banking Hubs.”

2]. To provide a charity with volunteers and funding to advise communities throughout the U.K., on how to build and run their own “Community Electricity Generating Station.”

These two core solutions may seem unachievable to some. We would simply reply that we and those within our network have, across the past 28 years, registered and run charities that have achieved the results originally set out for each charity. Indeed, exceeded those results.

The charities and projects within our community group have, by sheer good luck, the experience and skillset to make the answers and solutions above… happen.

^^ A New Registered Charity Will Be Born Of ^^ ^^ This “Calum’s List” Memorial Website ^^

Our aim is to pragmatically cure the ills on the core rules by which we stand…

********

Apologies whilst this next part of our main page is being bedded in. The new lead-custodian here just keeled over.

Consequently, this part of the page is bit more dynamic (work in progress) than would normally be the case with one of our websites. Hopefully readers will understand, we have only recently been handed the keys for this website and you can understand the challenges of a fairly monumental task of reducing the number of debt-suicides. Thank you.

For the purpose of this introductory page outlining the new Calum’s List ways to reduce the number of these tragedies, our internet website wizard keeps banging on about only placing “bite sized” chunks on the website, otherwise some ignorant Amadan with the attention span of a goldfish on valium will write TL:DR (Too Long: Didn’t Read) and they will end up on the Darwin List of ex-human beings!

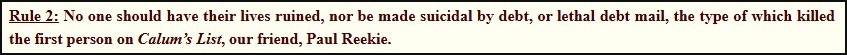

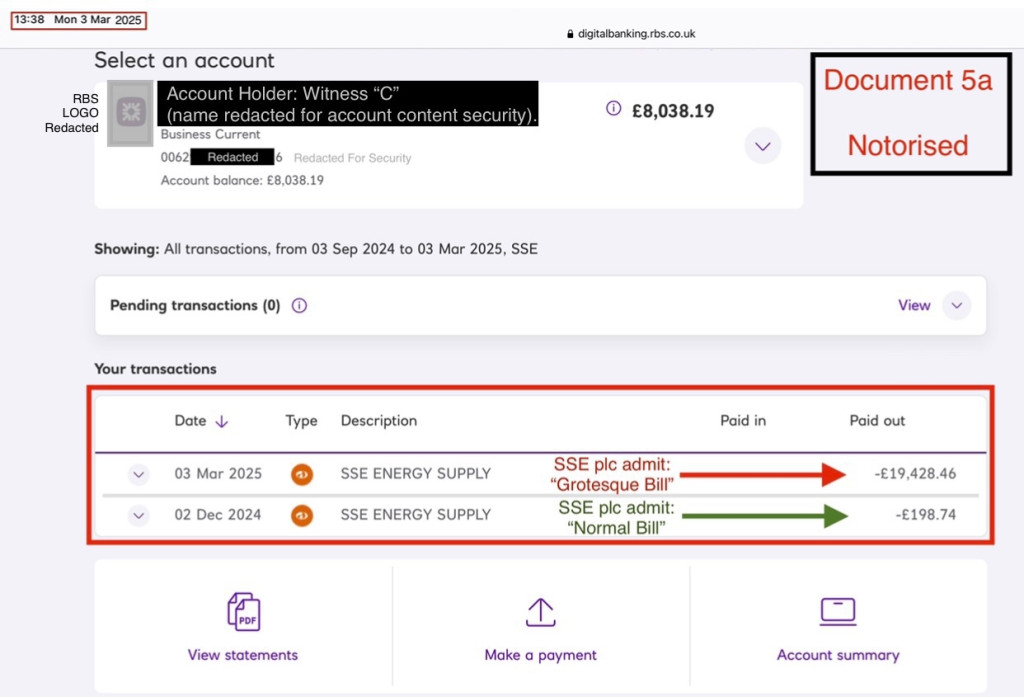

Besides, An electricity company just tried to (accidentally) kill our website custodian.

Not with an electric shock. They “accidentally” removed £19,428.46 instead of £198 from our “High Street Rescue Initiative” job creation business centre…

^^ Would It Stress You if Your Electricity Company Took ^^

^^ A Direct Debit of £19,428 instead of £198 From You? ^^

Our charity trustee (and his day-job as a CEO) already survived a stroke after being hit on the head by a 5,000 ton CalMac ferry.

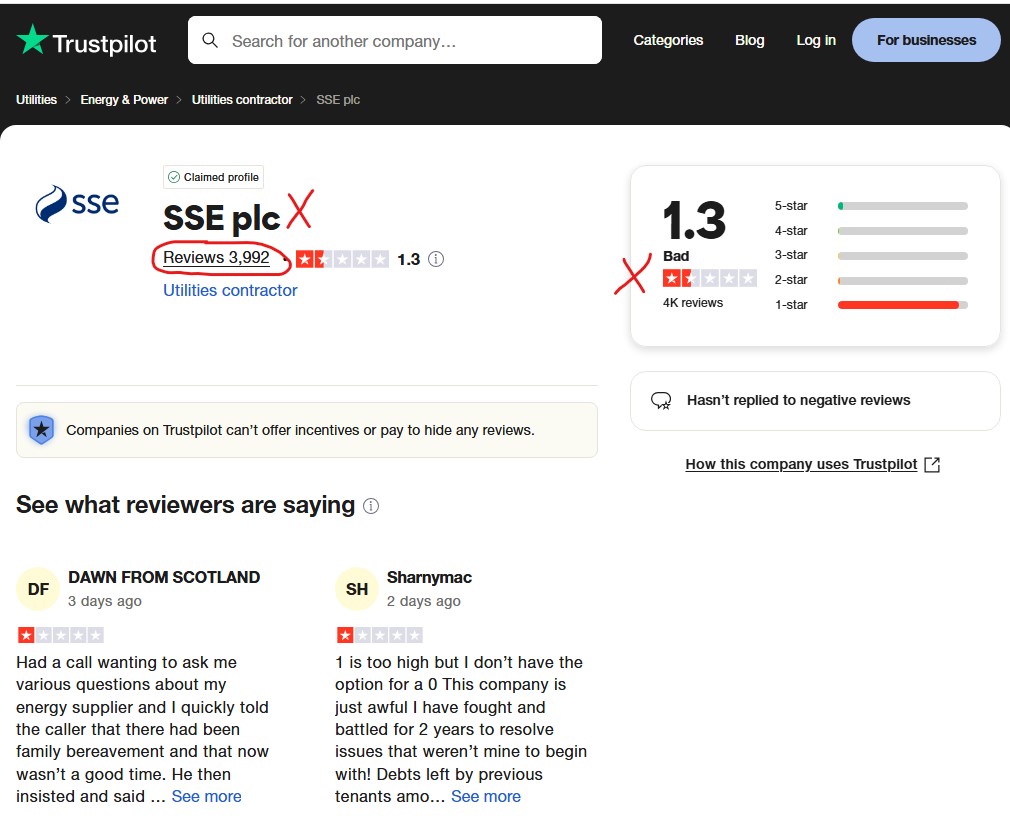

Now we have electricity provider, SSE plc (here and here) pulling this shocking overcharge direct debit stunt. Worse, they know he is a stroke-survivor.

Fortunately, our day-time business is run in a manner that BANS any bank borrowing. So we can well afford to LEND this electricity outfit £19,428 for its illegitimate bill whilst “Sir” John Manzoni, has yet to answer questions about SSE plc (alleged) culpability for causing a stroke survivor a second stroke during his (Manzoni’s) being head of SSE plc? Crucial to Manzoni’s position as penultimate SSE plc boss (and HSE legal “directing mind” responsibility) is the fact that his previous CEO is leaving/absent/has left and the new CEO is not yet in post. Ergo we aver in law, John Manzoni is the legal, “directing mind” at SSE plc. Specifically in terms of relevant HSE legislation.

Due diligence has turned up the fact, Sir John Manzoni, main boss at SSE plc., has “previous form” for questionable conduct in 15 deaths at an earlier company where he was boss: click here.

How Manzoni got the job at SSE plc needs an audit; specifically in relation to John Manzoni’s “previous” issues with his relationship to Health & Safety and 15 deaths: click here. This raises alarm bells with our Advocate (Scottish barrister) as there is a background of evidence that when assembled, brings a perspective which is, to say the least, of serious concern.

Following the injury (TBI stroke) to one of our directors, allegedly caused by highly dysfunctional, top ranking SSE plc electricity company, we are far from neutral. But, in an unusual circumstance, we have several police officers and former police detectives volunteering here. It took one of our crew just a few minutes to locate highly disturbing inquiries at a company run by John Manzoni. A vital document being the internal BP “Bonse Report” ~ click here.

Consequently in fairness to Manzoni et al., we believe an independent inquiry of the peer-review level that saw some transparency and justice at Sir Alan Bates’ Post Office Horizon scandal (here) should now be applied to the management protocols at SSE plc.

As for a keeping knighthood when there are 15 fatalities on your CV (here) and you run a company that a vast number of customers’ believe and state to be run so badly (4001 people/witnesses: here)… that your stewardship of that company (to your full knowledge) causes a stroke survivor to have another stroke, is something our lawyers say we can no longer comment on due to sub judice rule and how SSE plc remedy the allegations of HSE safety infraction.

***********

But it has delayed the main part of how we will help you or your family and friends avoid ever being a wage-slave or the subject of a Fatal Accident Inquiry if, Heaven forbid, the debt worries become too much and another UK citizen take their life.

The grotesque £19,428 direct debit above is all the more upsetting as we THOUGHT that SSE plc were a GOOD company.

A LOT of SSE plc staff ARE GOOD and help people with disabilities.

Some SSE plc folk seemed to take a genuine interest in our new charity’s solution to help…

Cure The Winter Fuel Allowance Controversy

By REDUCING the electricity costs of everyone.

But SSE plc have blotted their copy-book a bit. We will let you know how that ends.

**********

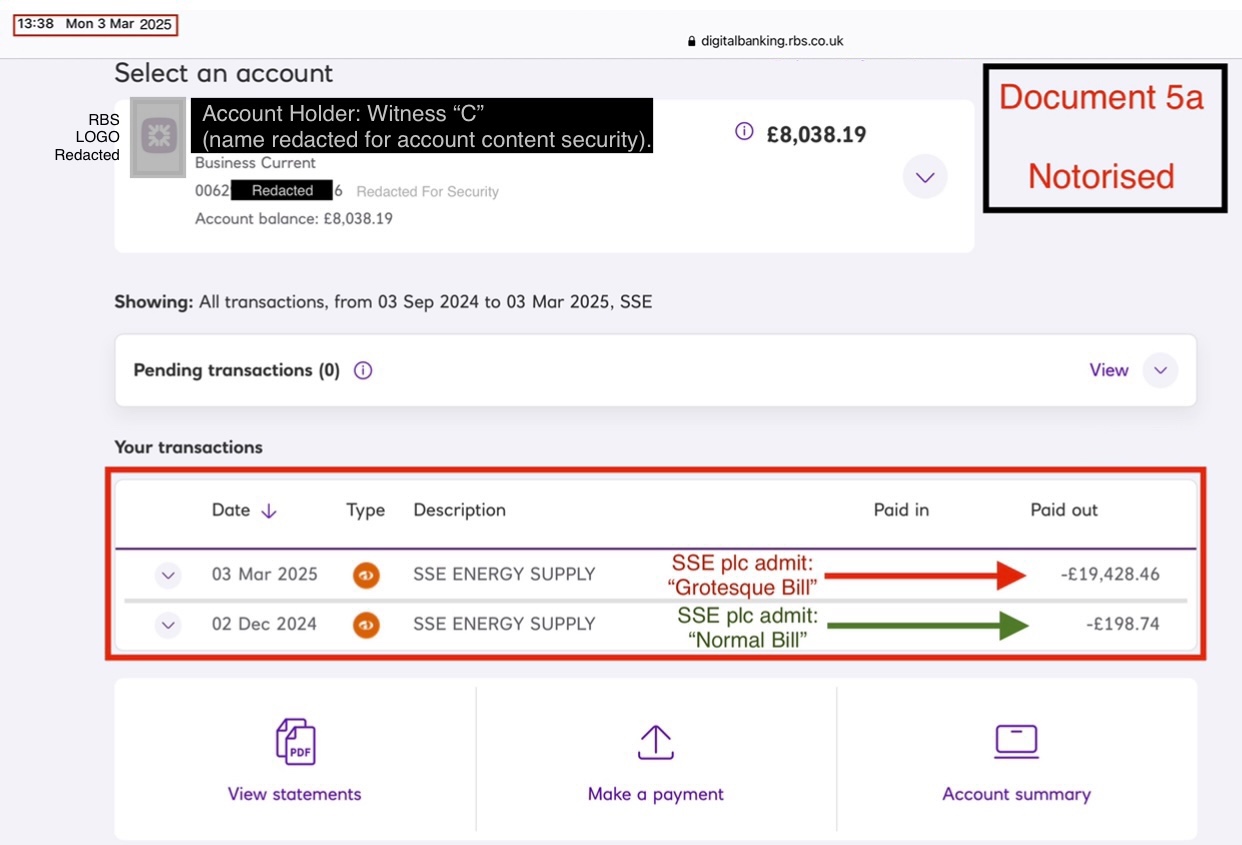

One Solution To Horrendously High Electricity Bills

Community Owned Power Stations

This may seem far fetched, but when you have a bunch of bored millionaire disabled people wanting to see if things can be made better… well two of them have been bidding on reservoirs for a fair amount of time so as to fulfil the new COMMUNITY HYDROPOWER element of the charity’s objectives.

For Example…

^^ Proof of Concept ^^

^^ Will Community Owned Hydro Electric Power Stations Work?

These don’t have to be an ugly solution either. This is how our American cousins build their hydro-electric generator stations…

^^ Boldt Castle Power Station ^^

^^ Photo Chao Feng Lin. Alamy Fee Paid ^^

For this front page of the NEW Calum’s List we must draw this narrative to a close until we find out if Calum is going to pull through the stroke SSE plc just (allegedly) caused.

But he is a stubborn old Glaswegian and very keen on HALVING the electricity bills of every community in the UK who would like that. So fingers crossed.

**********

P.S. Finally, below this segment, we have modest extra video that may give YOU an idea of how WE are looking at REPAIRING some of the BROKEN public sector elements and vast numbers of citizens for whom the politicians are clearly failing to keep safe.

Especially given the political tsunami of the recent local elections that clearly knocked both ruling political parties off of their perches.

**********

For Our New Charity Debt-Advisors

& Anyone Who Wonders How Banks’ Screw Our Clients

This is one of the most remarkable random acts of human kindness we have ever witnessed. Well done you wonderful Welsh champion, Michael Sheen…

^^ Michael Sheen Deserves An O.B.E. For This ^^

***********

There may be temporary duplication of some segments whilst we build a new version of this website. The structure and architecture of an internet site can be more complex at the start and the content is fluid at the start until the text and photos + graphics are sorted out. Plus a number of our volunteers are disabled, so a fair amount of “live” editing plus grammar and syntax is undertaken daily as volunteer time allows.

Shockingly Bad SSE plc

Grab £19,428 & Cause Our Founder To Keel Over

Last but not least…

This NEW version of Calum’s List should return in the next few days depending how our old cop/current custodian of a dozen new helpers, most of whom do not yet lnow exactly what Calum’s List is for! Well we get the first three rules.

But we kind of need the Old Fella.

Calum has been shot, stabbed and ended up battling through plate glass windows. When the medics were carting him off with a supected second stroke (allegedly) caused by SSE plc and about 5 hours “on hold” over many 5-hour sessions daily during a week of stress, his last words were..

“Never did I expect to killed off by an SSE plc bill of £198 accidentally go to £19,400. Twice.”

All we can see is the Amadans in charge of the diabolical SSE electricity company raided our banks with their dodgy direct debits a account, as proven by this…

^^ SSE plc Are A Shockingly Bad Company ^^

Don’t take our word for it… 3,992 customers have given the majority verdict here…

As well as trying to kill off one of our stroke-surviving crew with a second stroke, this overpromote, overpaid CEO called Alistair Phillips-Davies and his crew (here) have proven SSE plc really do need to be investigated by independent auditors by the verdict of 3,992 customers listed above.

Worse..

SSE plc Boss Alistair Phillips-Davies Paid

Paid £4,500,000 A Year

& Given a CBE For Risking The Lives of Stroke Survivors

Along With Too Little Done To Help

Freezing/Starving Pensioners

^^ SSE plc Electricity CEO Alistair Phillips-Davies (Here) ^^

PA Images & Alamy Fee Paid: Click Here

.

***********

.

Calum’s List

Please Check Back At Around

9pm Each Sunday Evening

For News & Updates

***********

Social Media

.

Click Here

.

This is a new social media page so is just becoming established

***********

.

.

.

.

.

.

.